商业环境

10 Business Tips for Thriving in Vietnam

1 7 月, 2024

Vietnam, a country with a rich cultural heritage and a rapidly growing economy, has become an attractive destination for foreign investors seeking new business opportunities.

Despite encountering substantial challenges from a difficult external environment and diminished domestic demand, Vietnam’s economic prospects remain resilient. The Asian Development Bank (ADB) anticipates the country’s GDP growth to reach 5.8% in 2023, marking the highest growth rate among ASEAN nations. Therefore, Vietnam’s global investment appeal remains strong. In the latest Business Confidence Index (BCI) Q3/2023 released by the European Chamber of Commerce Vietnam (EuroCham), 63% of surveyed businesses positioned Vietnam within their top 10 FDI destinations globally.

As the Vietnamese market continues to evolve, it is crucial for foreign entrepreneurs to understand the local business landscape and adapt their strategies accordingly. In this article, we explore 10 business tips for foreign investors looking to thrive in Vietnam.

1.Engage a local consultant for in-depth insights

To navigate the complexities of Vietnam’s business landscape, legalities, and investment procedures, businesses should partner with a reliable local consultant. The intricate tax system, inconsistent application of regulations, and trade restrictions can be formidable challenges for investors. There are several options to navigate the Vietnam market such as top-tier firms like Baker McKenzie and Boston Consulting Group to the big four—KPMG, EY, PwC, and Deloitte. Additionally, entities such as Dezan Shira and Associates, AASC, CPA, Mazars, and Kreston provide expertise tailored to specific needs and budgets.

For example, the VAT refund processes for manufacturing enterprises can be perplexing and may lead to issues concerning tax arrears. Local consultants can help foreign investors navigate this complexity effectively.

2.Leverage a law firm for legal guidance in all procedures

When entering a new market, the investor may encounter a vastly different culture, legal system, and operational processes compared to their home country. Seeking the assistance of a legal partner to navigate and ensure compliance with local regulations is essential for businesses to mitigate risks and pressures. Numerous projects in Vietnam experience prolonged procedures, with wait times exceeding over a year for investment registration and land-use certificates, and even more prolonged durations for projects falling under the Prime Minister’s licensing authority. To expedite administrative processes, enterprises should familiarize themselves with investment laws and seek appropriate legal counsel.

3.Choose a strategic location for business and production set-up

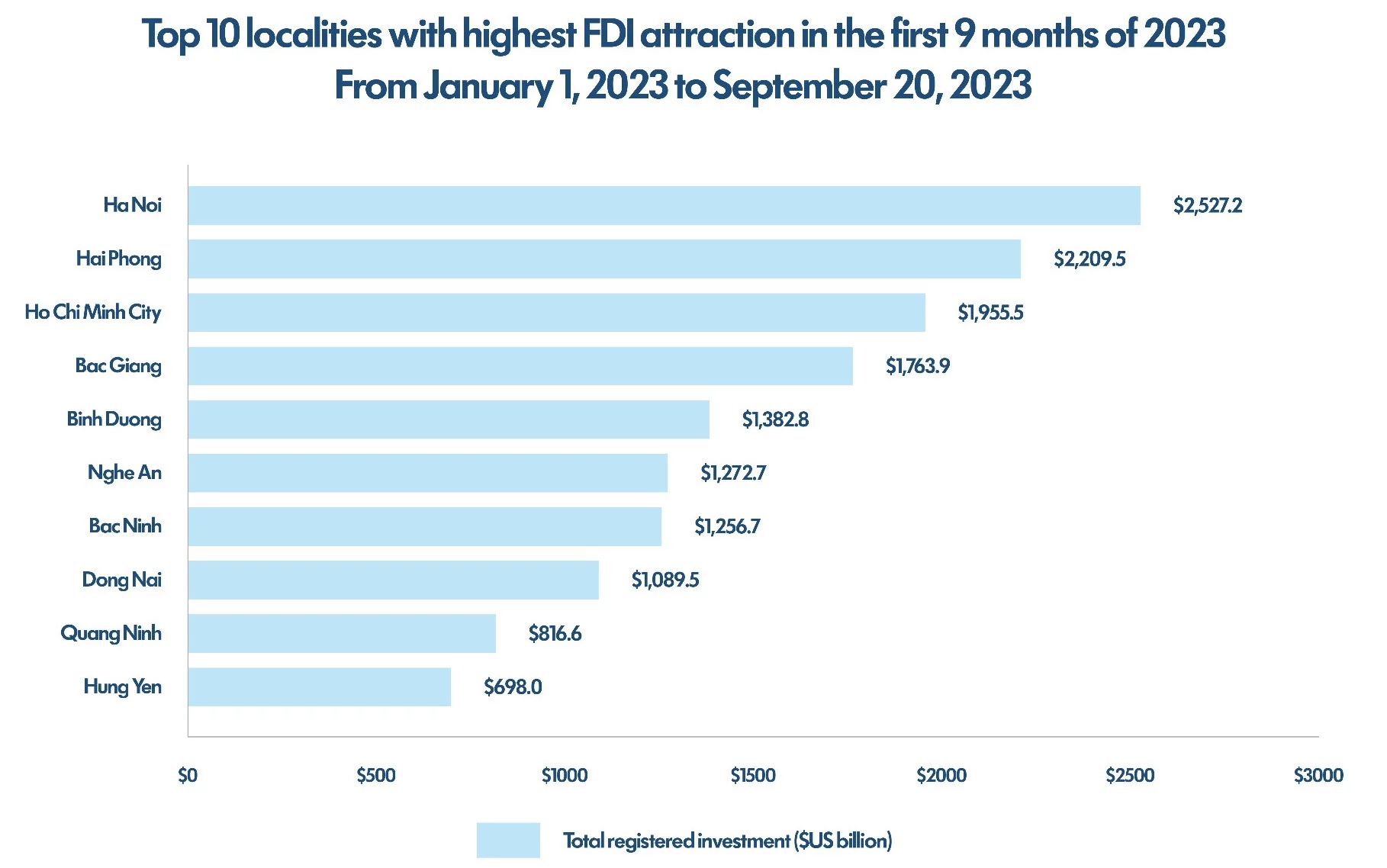

When establishing your business, carefully select a strategic location, preferably within a two-hour drive to major hubs like Hanoi or Ho Chi Minh City, as well as international seaports and airports. Beyond distance considerations, infrastructure may be an element that investors also need to consider. Proximity to well-developed infrastructure or designation as a key investment area can transform initially undesirable areas with low rental fees and competitive labor costs into ideal spaces for future trading activities. If undecided, consulting the list of provinces and cities with the highest foreign direct investment (FDI) attraction, such as Hanoi, Ho Chi Minh City, Hai Phong, Bac Giang, Binh Duong, Nghe An, Bac Ninh, Dong Nai, Quang Ninh, and Hung Yen can guide your decision-making process.

Source: Ministry of Planning and Investment

4.Recruit Vietnamese people for your board of directors to have better communication with related ministries and agencies.

Understanding the culture and business norms in your host country is crucial. Local staff can play a pivotal role in expediting the adaptation to the culture and fostering swift connections with the local business community.

5.Strictly follow government regulations on construction permits, fire prevention, wastewater treatment and environmental impact assessments during construction time to avoid unexpected costs

Click HERE for further information.

6.Add 10% of contingency cost in construction to avoid overbudget

There are costs that are hard to anticipate. Unforeseen costs may arise from factors such as construction re-planning, increased expenses for foundation/pile construction due to local soil conditions, or additional outlays for soil reinforcement to prevent subsidence.

7.Establish a quality control department from your home country or provide additional training for your staff to prevent discrepancies in specifications between countries

This precautionary step aids businesses in maintaining product quality, mitigating the risk of product recalls, and averting damage compensation issues prevalent in the current export market.

8.Opt for leased factories instead of acquiring land to expedite implementation, free up cash flow and freely expand on demand

Find out more about the benefits of the ready-built factories HERE.

9.Do not solely count on minimum wage when recruiting your labor force

Add 25%-30% of the minimum wage to make the job more appealing and stand out from what competitors are offering.

10.Use international payment banking services to sidestep difficulties in paying/receiving international transfers or issuing LC or escrow accounts for export consignments

Foreign banking institutions that have branches and representative offices in Vietnam are HSBC, Citigroup, Shinhan and Standard Chartered, among others.

Vietnam presents a wealth of opportunities for foreign investors, but success requires a deep understanding of the local culture, market dynamics, and regulatory landscape. By embracing these 10 business tips, foreign entrepreneurs can position themselves for success in this vibrant and rapidly evolving business environment.

To learn more about policies, receive advice for foreign manufacturers in Vietnam and obtain free support from BW, please contact our hotline (+84) 28 710 29 000 or email leasing@bwidjsc.com